Fiduciary financial advisors are not salespeople; they are required by law to work in your best interest at all times.

How can you know the difference between a financial advisor and a financial consultant or a wealth manager? How does a financial planner differ from a registered representative or an investment advisor representative? What is a fiduciary financial advisor.

Do these titles hold significance? Do they effectively distinguish between the real deal and the impostors? How can you tell the difference between those who have real training in finances and investing and those who don’t?

No, unfortunately not.

Regrettably, there is very little regulation around titles in the financial industry, so almost anyone can call themselves a “financial advisor” regardless of how little formal education they have in finance. These titles serve primarily as a way for an individual advisor to claim what they believe they are able to do or what association they belong to.

To make matters worse, there seem to be even more random titles and designations popping up: “3-Dimensional Wealth Practitioner”; “Financial Paraplanner Qualified Professional”; “Global Financial Steward.” Again, there are very few standards regarding what each of these titles mean and what qualifications a person must have in order to use the title.

Even the most well-known designation, the CFP©️ (Certified Financial Planner), is not all that it claims to be, as I will discuss below. The fact of the matter is that CFP©️s are not always fiduciaries. In fact, the vast majority of CFP©️s are brokers, collecting commissions and not true fiduciary financial advisors.

It is easy to understand why there are so many designations. In the United States, there are many “financial advisors.” According to FINRA, the agency that regulates financial advisors, there are 689,925 as of 2022 (FINRA, 2022). With so many advisors out there it can be difficult for an advisor to stand out from the crowd. Having certain titles after their name, even if the titles mean very little, can be a way that advisors try to stand out.

Amidst all this confusion, it’s crucial and quite surprising to note that the vast majority of financial advisors aren’t obligated to prioritize your interests over their own. So, how can you distinguish between advisors who genuinely aim to assist their clients and those who are focused on selling products? Continue reading to discover key factors to consider when embarking on the search for a financial advisor who aligns best with your needs.

Types of Financial Advisors: Why you should work with a Fiduciary Advisor

There are three (3) types of financial advisors out there:

- Brokers

- Fiduciary Advisors

- Dual-Registered Advisors

It is critical to know the differences between each type of advisor.

Brokers

A broker is a financial advisor affiliated with a broker/dealer, an insurance company, or both. They earn their compensation through commissions or fees from the sale of financial products to clients. Many of the large financial firms, such as Merrill Lynch, Edward Jones, Morgan Stanley, Ameriprise, among others, operate as broker/dealer firms. Approximately 89% of financial advisors in the U.S. operate as brokers. The most important distinction is that brokers are not obligated to suggest the product financial product that is best for their client. Let me say that again in a slightly different way: 89% of financial advisors do not have to offer the client the financial product that is best for the client. Brokers are required only to offer an investment that is suitable for the client. In legal terms, they are bound to meet only the suitability requirement, which sets a relatively minimal standard. This requirements means that the investment the advisor recommends must be suitable, that is to say, okay for the client, but it does not have to be the best recommendation for the client.

To be clear and straightforward, not all broker/dealer financial advisors are deceitful or untrustworthy. The majority of advisors in these firms are reputable individuals. Having worked at one of the largest global broker/dealers, I can attest that most financial advisors genuinely strive to benefit their clients. Nevertheless, brokers face a notable conflict of interest: their compensation is tied to selling financial products to clients.

However, even when a broker is deemed trustworthy, the method of compensation, namely through commissions, raises significant doubts about their motivations and guidance. Brokers are incentivized to promote high-paying products that yield substantial commissions for themselves and their firms. Their preference for certain products over others is often driven by the potential for higher fees rather than the client’s best interest. Given a choice between a high-fee actively managed mutual fund and a low-fee passively managed ETF, brokers typically opt for the former despite the latter being a more suitable option for the client. This bias towards actively managed funds stems from their lucrative nature in terms of commissions for the advisor.

7 Questions To Ask A Financial Advisor

We know that finding the perfect financial advisor can be intimidating. You may have the following questions in mind, “How do I know if an advisor has my best interest at heart? Are there any hidden fees? Do they even know what they’re doing with my money?” We have created this guide to simplify the process and to help you along the way. Download now to avoid the biggest mistakes people make.

*Privacy policy: we will treat your email address as we would have others treat ours.

Fiduciary Financial Advisors

Now this is where it gets even more confusing. According to 2022 data, the U.S. has 689,925 financial advisors, with 385,058 (55.8%) aligned with Registered Investment Advisor (RIA) firms. The apparent discrepancy arises from the fact that both Independent Advisors (11.2%) and Dually Registered Advisors (44.6%) fall under the RIA umbrella. Despite this overlap, there is a very important distinction exists between these Independent Advisors and Registered Advisors, which I will clarify in the next section.

While there are many types of designations in the finance industry, as we have been discussing, there is one designation that has clear legal restrictions that guide the advisor’s work. Registered Investment Advisors, know as RIAs, are required by law to place their client’s interests before their own at all times. This is known as the fiduciary standard and it is the same standard that an attorney must hold with their client. Einstök Wealth is, of course, an RIA, and we take our fiduciary responsibilities very seriously . This fiduciary requirement is the highest standard in the financial services industry. It is so onerous that we have to disclose any potential conflict of interest and potential risks to the public, again, much like an attorney must do with their clients.

According to Investopedia, RIAs have a “fundamental duty to always and only provide investment advice that is in their client’s best interests.”

Financial planning that matches your ambition.

Financial advisors for successful professionals, executives, and business owners.

Dual-Registered Advisors

When faced with the choice between a broker and an RIA advisor, the decision may appear clear-cut: opting for an RIA advisor is ideal since they are mandated by law to prioritize your best interests over their own. Yet, the reality can be more ambiguous. The key concern lies here: Most of the independent fiduciary advisors do not always act as fiduciaries 100% of the time. These financial advisors fall under the category of Dual-Registered Advisors. Dual-Registered Advisors are financial advisors who maintain registrations both as brokers and as RIAs simultaneously and are capable of transitioning between fiduciary and non-fiduciary roles with their clients.

The ability of a dual-registered advisor to act as both an independent fiduciary advisor and a product-selling broker for commissions raises significant ethical concerns. While these advisors may initially position themselves as fiduciary financial advisors, emphasizing the priority of clients’ interests, they can later switch hats to recommend products that may not align with what’s best for the client. Despite being legal, this dual role is common among independent advisors who may claim to be fiduciaries without consistently acting in the clients’ best interests.

A true fiduciary financial advisor is always a fiduciary for their client and never acts as a broker. Only 11% of financial advisors in the U.S. are true fiduciary financial advisors, and we at Einstök Wealth are proud of the fact that we are always a fiduciary, always acting in our client’s best interest.

Are CFP©️ Advisors Fiduciaries All The Time?

Most Certified Financial Planners (CFP©️s) do not consistently act as fiduciaries. In reality, the majority of CFP©️s are brokers who earn commissions. In my view, if a CFP©️ receives a commission, it creates a significant conflict of interest, and they may not be seen as genuine fiduciaries.

It is important to note that the CFP designation is self-regulated. The CFP Board is an organization that polices itself, and its members do not face legal consequences if they breach fiduciary responsibilities. Instead, if a member fails to adhere to the CFP©️ code of conduct, they risk losing their CFP©️ credential and membership.

True Independent Fiduciary Advisors

Out of the 385,058 Registered Investment Advisors (RIA) in the U.S., 307,590 are Dual-Registered Advisors. This indicates that only 69,482 RIAs truly act as fiduciary investment advisors without significant conflicts of interest. This group constitutes just 11.2% of the 689,925 financial advisors in the U.S.

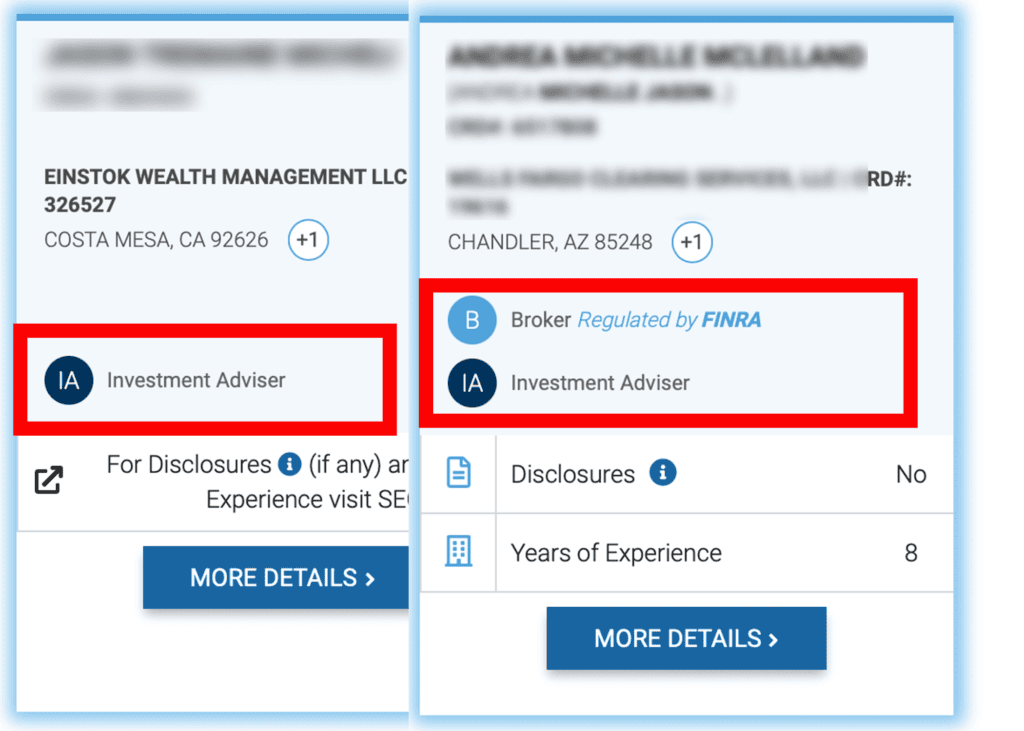

To determine if a financial advisor is a fiduciary, a broker, or both, follow this straightforward approach:

- Visit the website brokercheck.com.

- Search for a the financial professional you would like to get information about.

- Check whether this individual is an investment advisor, a broker, or dual-registered.

Ensuring that your financial advisor acts as a fiduciary advisor 100% of the time is arguably the most critical step when considering a financial advisor. However, this is just one of several essential questions you should address.

Based on our experience in the industry, we have compiled what we believe are the top 7 questions to ask to a financial advisor before engaging their services.

Selecting the right financial advisor can be daunting. You are entrusting your net worth to this individual, so it’s vital to verify not only their competence but also their ethical standards.

Please take advantage of our complimentary resource below. Don’t hesitate to contact us if you have any questions you would like to discuss.

7 Questions To Ask A Financial Advisor

We know that finding the perfect financial advisor can be intimidating. You may have the following questions in mind, “How do I know if an advisor has my best interest at heart? Are there any hidden fees? Do they even know what they’re doing with my money?” We have created this guide to simplify the process and to help you along the way. Download now to avoid the biggest mistakes people make.

*Privacy policy: we will treat your email address as we would have others treat ours.